Disbursement Policy & Procedures

Federal Pell Entitlement

Federal Pell funds are calculated based on a student's enrollment at the time of disbursement.

Example: Student A is enrolled in 12 credit hours for the term. At the time of the first disbursement, Student A is only enrolled in 9 credit hours. Student A is entitled to 75% of their full award. At the time of the second disbursement, the student increases their enrollment to 12 credit hours. The student at the time of the second disbursement will receive an additional 25%.

| 1st Disbursement | 2nd Disbursement | ||

| ENG-112 3 credit hours |

MAT-143 3 credit hours |

HIS-131 3 credit hours |

SOC-210 3 credit hours |

The following chart can be used to determine a student's eligibility based on their enrollment status at the time of disbursement.

| Federal Pell Grant Enrollment Status | ||

| Enrollment Status | Eligibility | |

| 12+ credit hours | full-time | 100% |

| 9-11 credit hours | three-quarter time | 75% |

| 6-8 credit hours | half-time | 50% |

| 1-5 credit hours | less than half-time | 25% |

| A student's EFC can affect their eligibility if they are enrolled in less than full-time status. | ||

For details on state grant eligibility, please visit North Carolina Need-Based Guarantee Scholarship.

Things to Keep in Mind

- Attendance must be verified in all courses.

- The Financial Aid Office cannot pay for classes that do not count toward your program of study. It is important to work with your Advisor to ensure the classes you are enrolled in are required.

- Refund checks are mailed to the address on file. A student can check WebAdvisor under "My Profile" to confirm the current address on file. If a Change of Student Data Request form is needed, please submit to the Registrar's Office.

- Withdrawing from courses may decrease your enrollment status and the amount of aid applied to your account.

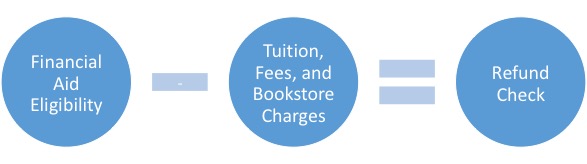

Calculating Refunds

If a student's financial aid eligibility exceeds the current balance for the term, the difference will be issued by check on the scheduled Disbursement Date.

Example: Student A is enrolled in 12 credit hours at the time of disbursement. Student A was awarded $3,048 for the semester. Based on full-time enrollment, $3,048 is disbursed to the student's account. Student A's total charges are $1,120. Student A's refund is $1,928. ($3,048 - $1,120 = $1,928).

What can Federal funds be used for?

Federal funds can be used for the following:

| Tuition and Fees | |

| Books and Supplies | Computer and Internet |

| Housing, utilities, and food | Educationally-related Insurance |

| Transportation: Gas, Public Transportation | Clinical Expenses |

| Childcare expenses while attending class | Tool Expenses |